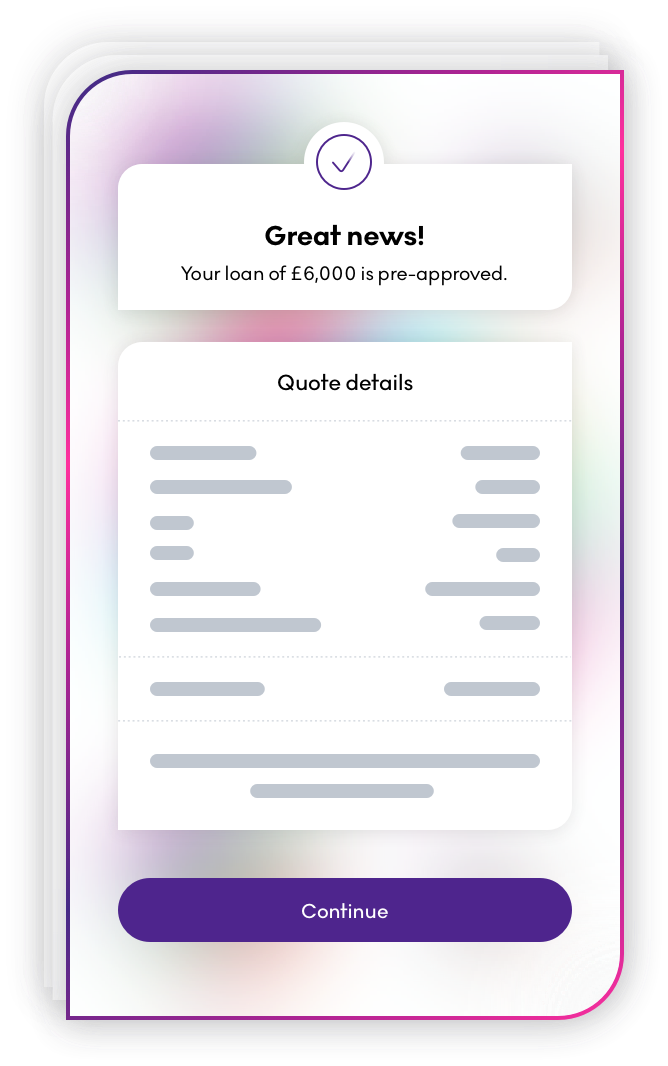

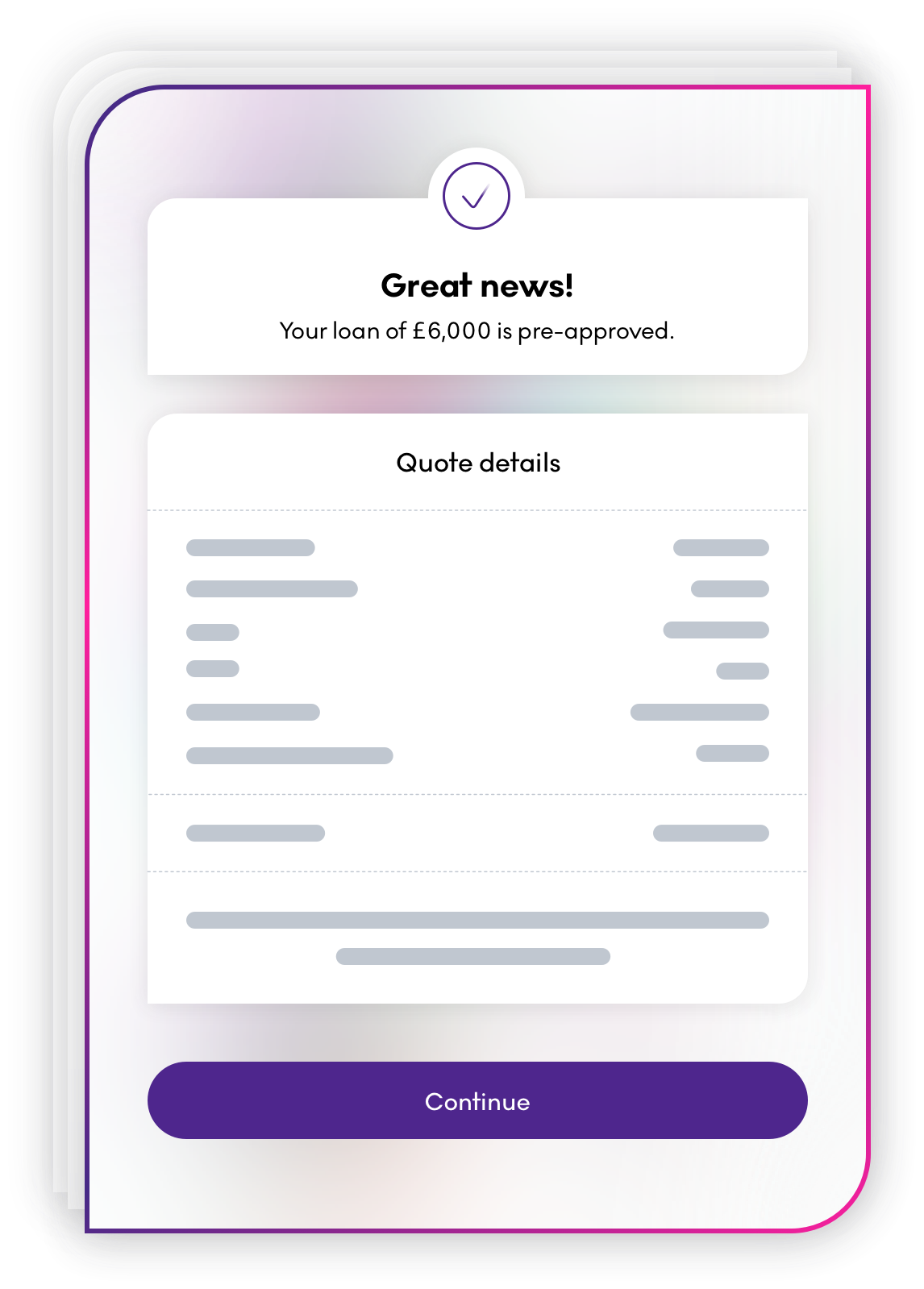

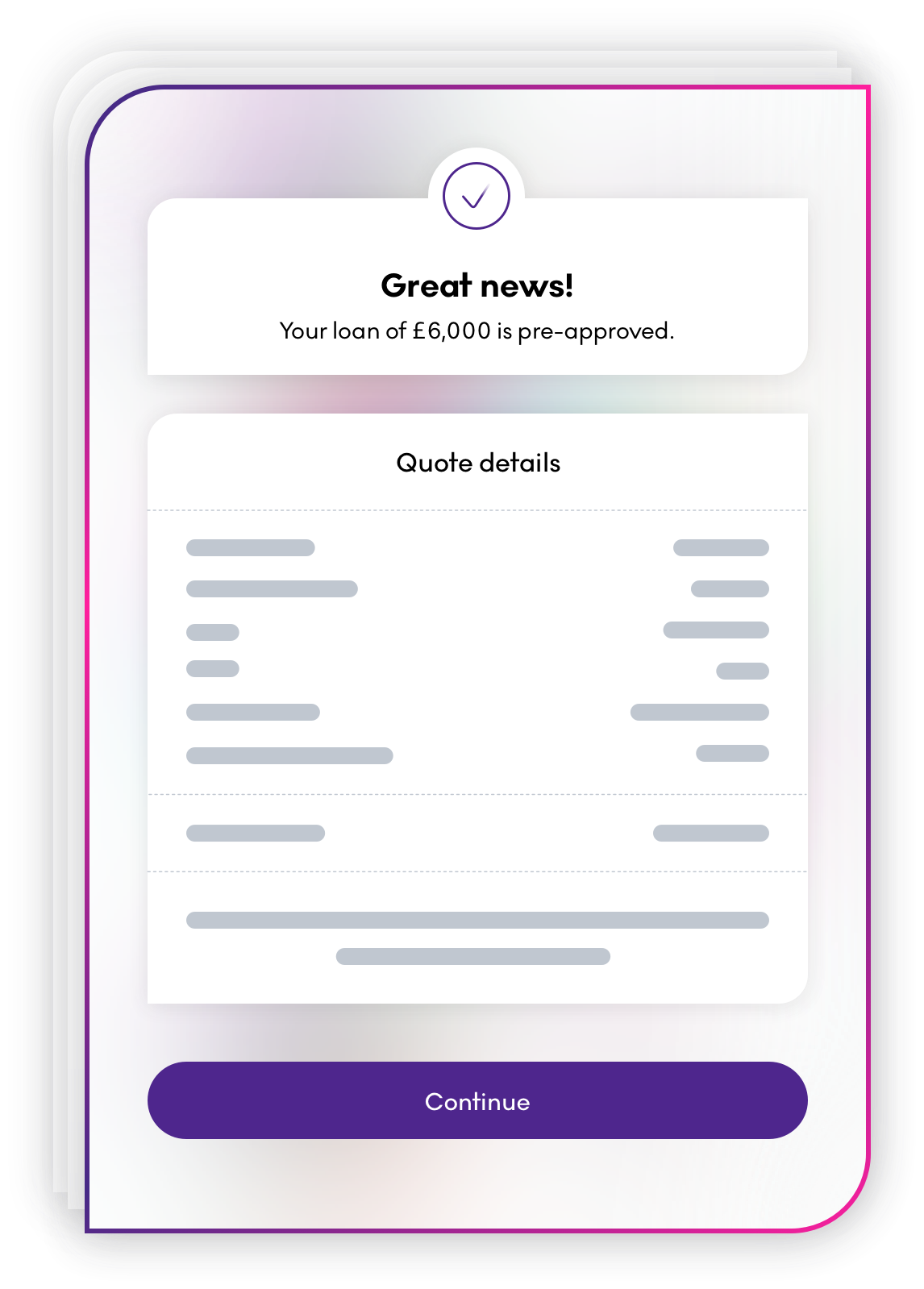

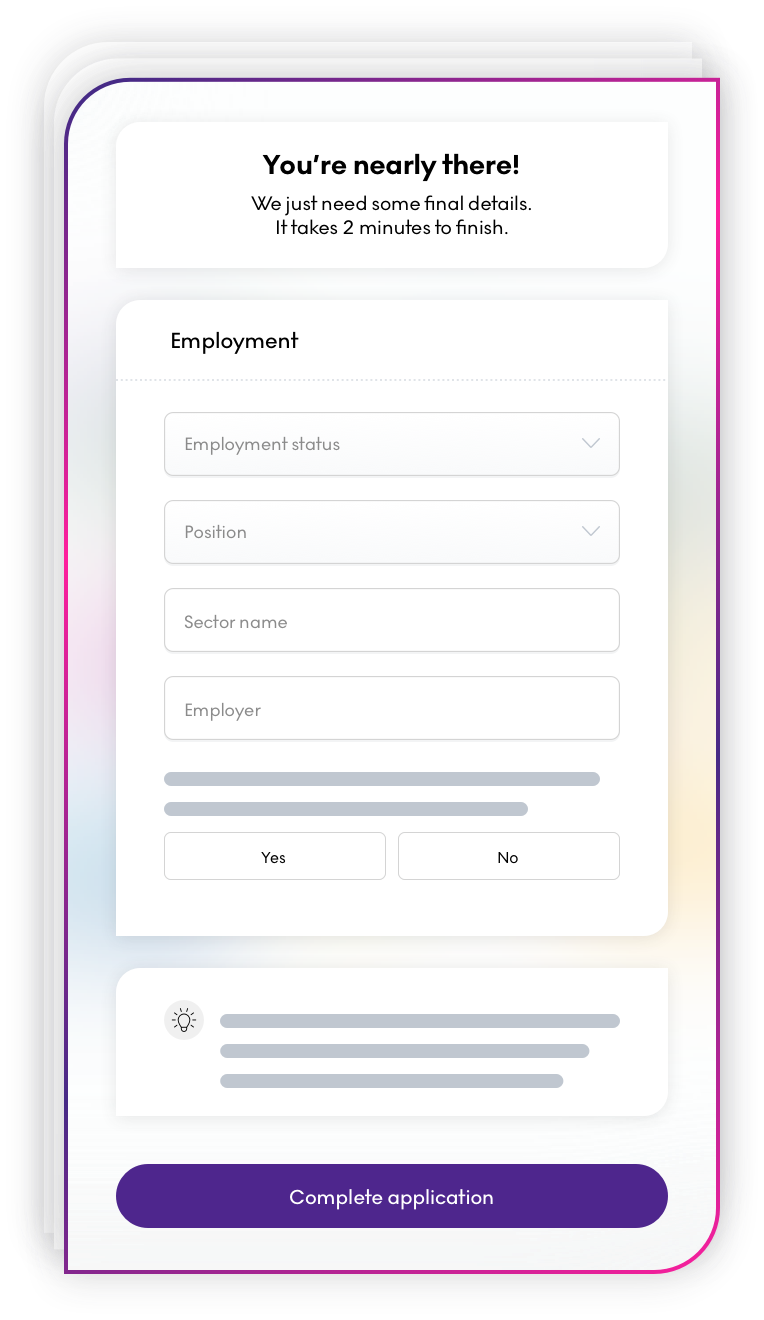

01 Easy application

Applying for a Fluro personal loan takes less than three minutes and approved loans will be in your account within 24 hours. Whether it's for home renovation, a life event, a big purchase, or debt consolidation, a Fluro loan is no fuss, real rates. Plus, if you're just looking for a quote, your credit score will not be impacted.

02 Real rates

Unlike representative rates, real rates are fair, personalised, and fully transparent so you know exactly what you're getting. Fluro personal loans are fast and simple, from the application process to the rate offered. See your real rate within three easy steps.

03 Flexible repayments

Repayment plans for your Fluro personal loan are flexible from day one. Make overpayments at no extra cost or settle everything at anytime. No stress. No waiting. No complications.

Our philosophy

Clear

No industry jargon. No complicated money stuff. No tricky wording. Just easy. Just human.

Transparent

See everything upfront so you're completely in control. And if there's ever anything not crystal clear, we're always here to help.

Fair

We use real rates instead of rep APR. With rep APR, 49% of people get a higher rate. With real rates you get what you see.

Helpful

From our user-friendly design principles to our highly-rated customer service, we're here to help. No detail is too small.

Let's talk numbers

You show us yours so it's only fair we show you ours; here are some numbers to help you judge whether or not you want to take out a Fluro loan.

Get a quoteCommon questions

Why have I been declined?

These are the common reasons why someone may be declined:

- We have been unable to establish affordability for the loan (your disposable income is too low)

- You have missed recent payments on credit

- We have been unable to verify your income at the level stated on your application

- Your credit score is too low (Fluro uses Experian to establish your credit score/creditworthiness)

- You already have a Fluro loan, but you have not yet made three payments

If you believe that your loan application needs to be reconsidered, please send us an email at underwriting@fluro.co.uk explaining why and we'll ensure that your application is reviewed again by a different underwriter. Our turnaround is 48 hours and further documentation may be requested.

Why is there a Fluro soft / quotation search on my credit file?

A quotation or 'soft' credit search enables you to shop around and see whether you might be approved for a loan and at what interest rate. It does not affect your credit score.

Often a soft search will be on your credit file if you are shopping around on price comparison sites and ask for a quote.

A hard or 'credit' search (which does affect your credit score) would be made once you apply for a Fluro loan. Hence, it is always advisable to ensure you provide the correct information when you apply to give you the best chance of being approved.

When will I get my loan?

Once you accept your loan request the loan proceeds are normally paid in your bank account within 24 hours, but often a lot sooner!

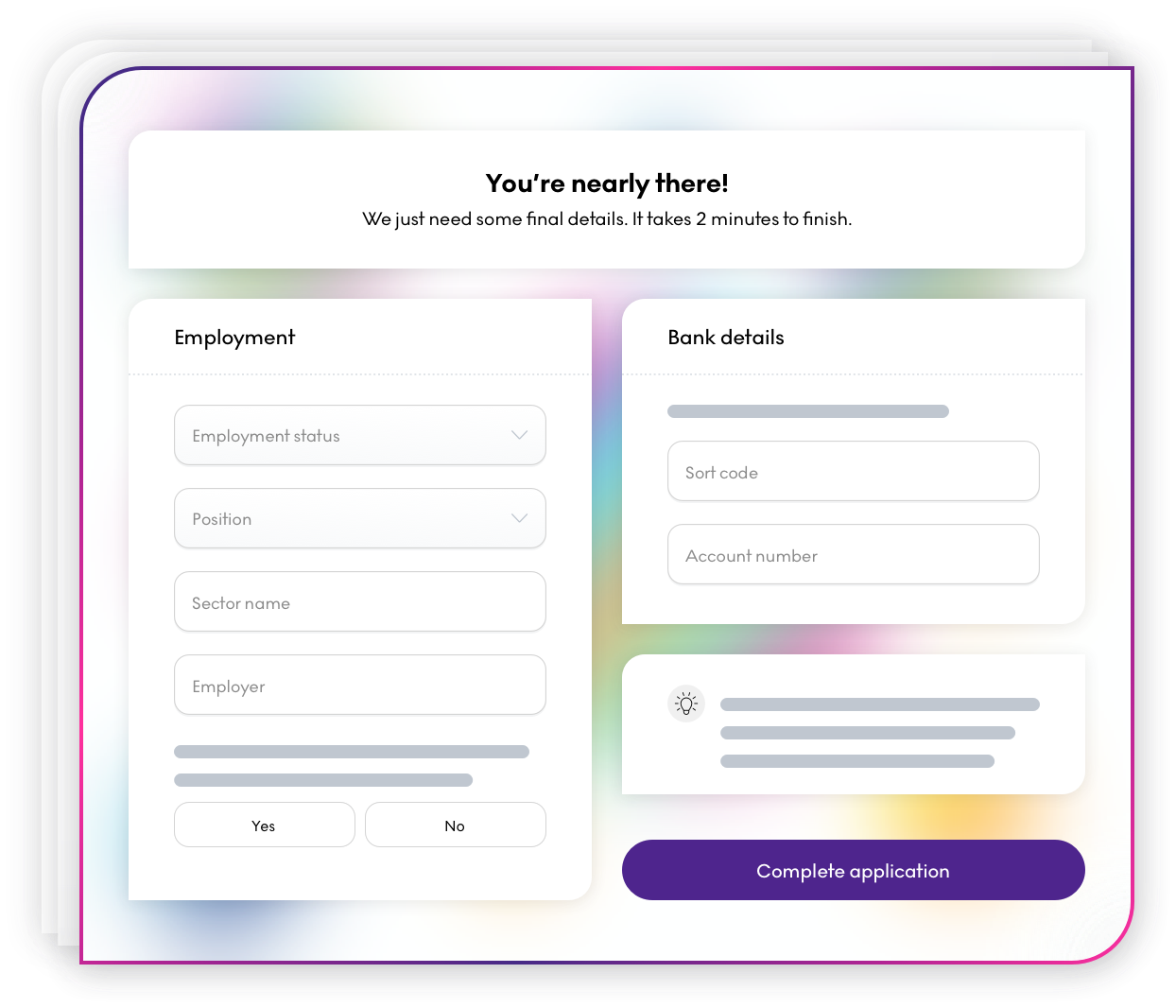

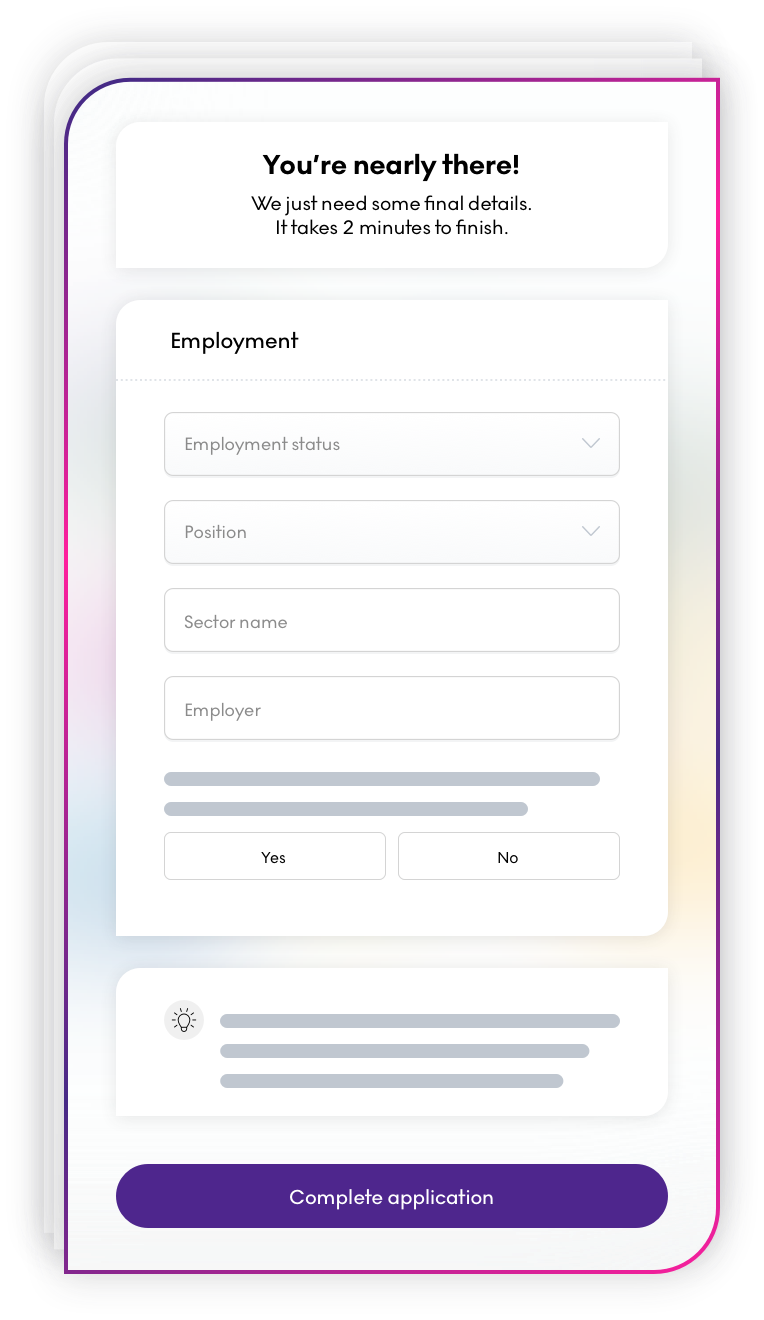

How do I accept my loan?

Once your loan application has been approved you'll receive an email from us to confirm. If you're happy with the APR (Annual Percentage Rate) and your monthly repayments and would like to proceed, you'll need to confirm that you wish to accept the loan offer. To do this, you should:

- Click on the link in the email and log in to your borrower dashboard

- Find the relevant loan and click ‘Accept loan offer’

- Read through and accept the loan documentation, and then click 'Continue'

- Confirm your bank details for your monthly Direct Debit repayment and review the Direct Debit Instruction, then click 'Confirm'

- We will confirm that the funds have been transferred to your account via email; likely on the next working day

How do I cancel my loan application?

If you decide you no longer want to proceed with your loan, you should:

- Log in to your borrower dashboard

- Select the loan offer you wish to cancel from the Quotes section

- Click on 'Cancel'

- Check the confirmation details

- If you still wish to go ahead with the cancellation, please select a reason for doing so from the dropdown and then click 'Cancel loan offer'

There are no charges for cancelling your loan.